Now loading...

Ever found yourself wondering about the secret sauce behind successful investors to learn How to Build a Diversified Investment Portfolio for yourself? How do they navigate the financial labyrinth and emerge victorious? Well, my friend, it’s time to unravel the mysteries of wealth creation. Are you ready to dive into the world of possibilities and learn how to build a diversified investment portfolio that stands the test of time?

Why Diversify? The Billion-Dollar Question to Build a Diversified Investment Portfolio

Why bother with a diversified investment portfolio? Simple – it’s the golden ticket to financial resilience. Diversification is like having a well-balanced diet; you wouldn’t eat the same meal every day, would you? Similarly, putting all your investment eggs in one basket is a risky game. The market is a wild beast, and a diversified approach helps mitigate risks and boosts your chances of financial success.

The Foundation Step to Define Your Financial Goals

Before you embark on your investment journey, ask yourself: What are you investing for? A cozy retirement, a dream vacation, or perhaps world domination? Define your financial goals, and let them be the North Star guiding your investment decisions. A diversified portfolio is not a one-size-fits-all affair; it’s tailored to your unique aspirations.

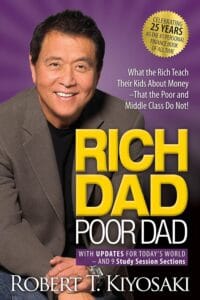

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!

Rich Dad Poor Dad is Robert’s story of growing up with two dads — his real father and the father of his best friend, his rich dad — and the ways in which both men shaped his thoughts about money and investing. The book explodes the myth that you need to earn a high income to be rich and explains the difference between working for money and having your money work for you.

In many ways, the messages of Rich Dad Poor Dad, messages that were challenged and criticized 25 ago, are more meaningful, relevant, and important today than ever.

Building Blocks: The Art of Diversification

1. Spread the Love with Asset Allocation

Building a diversified investment portfolio is like cooking a gourmet meal – it’s all about the right mix. Asset allocation is your recipe. Allocate your investments across diverse asset classes such as stocks, and cash. Stocks bring the sizzle, and cash is the safety net for stormy days.

2. The Stock Market Equities

Picture the stock market as a grand ballroom dance. Each company is a dancer, and you want to partner with the best. Distribute your investments among different industries and sectors. Tech, healthcare, energy – let your portfolio dance to the rhythm of diverse stocks. Remember, it’s not about one star dancer but a symphony of talents.

3. The Emergency Exit with Cash

Cash is your secret weapon, the exit door when the dance floor gets too crowded. Maintain liquidity for unforeseen circumstances or golden opportunities. Cash might not yield high returns, but it’s your financial parachute, ready to cushion any unexpected falls.

Beyond the Traditional Opportunities and Embrace Alternative Investments

Diversification isn’t confined to stocks, and cash. Explore the unexplored realms of alternative investments. It’s like adding exotic spices to your investment recipe – unconventional but potentially flavorful.

5. Building Wealth Brick by Brick in Real Estate

Real estate is not just about buying a house; it’s about constructing a fortress of wealth. Consider investing in residential or commercial properties, explore Real Estate Investment Trusts (REITs), or participate in crowdfunding platforms. Real estate doesn’t just diversify your portfolio; it can be the cornerstone of your financial empire.

6. The Timeless Treasures of Gold and Precious Metals

In times of economic uncertainty, gold and precious metals shine like beacons. These assets serve as a safeguard against the impact of inflation and currency fluctuations. Including them in your diversified portfolio adds a layer of resilience, like having a financial suit of armor.

Fine-Tuning the Symphony with Regular Review and Rebalancing

Your diversified investment portfolio is a living entity. Regularly review its performance, adjust your holdings, and rebalance to align with your financial goals. Market dynamics change, and so should your strategy. It’s like tuning a musical instrument – precision ensures harmony.

Navigating the Investment Jungle and Beware of Common Pitfalls

Building a diversified portfolio isn’t without challenges. Beware of these pitfalls that could turn your financial journey into a perilous expedition:

7. Keep Away from Overconfidence

Overconfidence can be the downfall of even the savviest investor. Don’t let a string of successes lead you to believe you’re invincible. Stay humble, stay vigilant, and always be prepared for market surprises.

8. Avoid Neglecting Risk Tolerance

Investing involves walking a tightrope between the interplay of risk and reward. Understand your risk tolerance – how much market turbulence can you endure without losing your balance? Tailor your diversified portfolio to match your risk appetite.

9. Never Ignore Market Trends and Stop Blindfolded Journey

Ignoring market trends is like navigating a maze blindfolded. Stay informed about economic indicators, geopolitical events, and emerging market trends. A diversified portfolio is agile, ready to pivot based on the ever-changing financial landscape.

Your Financial Symphony Awaits

Congratulations, intrepid investor! You’ve embarked on the journey to build a diversified investment portfolio, your ticket to financial prosperity. Keep in mind, success lies not in timing the market but in the time spent in the market. Stay diversified, stay informed, and let your wealth-building symphony play on for a lifetime.

So, ready to turn the page and start your diversified investment portfolio chapter? The financial stage is set, and the spotlight is on you. Let the wealth creation performance begin!

Now loading...